After a record-smashing 2021, 2022 will be remembered as the year of diminished dealmaking. The upward trajectory that began in the fourth quarter of 2020 and sustained through 2021 did not continue last year: Deal-making started off strong in the first half of 2022, but volume and value dropped significantly in the third quarter before rebounding slightly in the last quarter.

“Uncertainty” is the keyword as we sit at the beginning of 2023. Rising interest rates, inflation and geopolitical strife continue to challenge economic and market stability. But with about $1 trillion in committed capital sitting on the sidelines, deals will still need to be made.

What is in store for 2023? Will “low-quality” companies comprise a greater proportion of deal volume? Will gaps between buyers and sellers narrow? Will the Federal Reserve begin lowering interest rates mid-year? Here professionals at Hancock Advisors look at some of the trends we believe will play out over the next 12 months.

Prediction #1: Large cap deal flow will give way to more middle-market deals

In an inflationary environment in which interest rates are the highest they have been since the Great Recession and lending has tightened, private equity firms will continue to focus their energies on add-ons or carve-outs.

While multi-billion-dollar platform buyouts will still happen — the rout in the public markets last year provides welcome comps for larger buyouts — we predict a sizeable proportion of private equity M&A to be smaller to mid-size strategic plays that allow firms to put their capital to use. Competition over the limited number of quality assets will continue to be fierce, so we will see more deals of lower quality, as we did at the end of 2022.

During this period of ongoing uncertainty, due diligence continues to expand from the compressed timelines we saw during the deal frenzy of late 2020 and 2021. Firms will also continue to look to work with vendors who can supply a majority, if not all, of their due diligence needs.

Prediction #2: Fundraising cycles will continue to be lengthy

The amount of time firms take to raise funds has been increasing, and that dynamic will persist into 2023. The average number of months to final close in 2022 hit 20 months for the first time since 2010, according to Preqin data. That is an increase from 11 months in 2019 pre-pandemic; since then, the average number of months to close has ticked steadily upward, reaching 16 in 2021.

Last year, we saw limited partners (LPs) asking their general partners (GPs) to push some of their fundraising efforts into 2023 because they were unable to keep up with the re-up requests from GPs raising subsequent funds. Given the amount of capital raised in recent years and the fact that many funds that raised in 2022 never activated their funds due to the macro deal environment, we expect to see a delay in the deployment of capital, compounding the calls of capital on LPs if they commit to new funds.

LPs who have experienced the “denominator effect” — becoming overallocated to private equity given the public market decline — will be reluctant to make new commitments and may instead sell their stakes this year.

The declining rate of exits, of course, exacerbates these dynamics. Fewer exits mean fewer distributions to LPs. For LPs re-committing capital, we foresee risk aversion influencing a trend of dollars flowing to fund managers with proven (and lengthy) track records. However, emerging managers specializing in sectors align with LPs’ strategies and values will attract investment.

At the same time, the dynamics around fundraising may help to fuel the secondary market more and increase diversity among private market participants (think retail investors and high-net-worth individuals).

Prediction #3: Firms will take advantage of market slowdown to plan exits

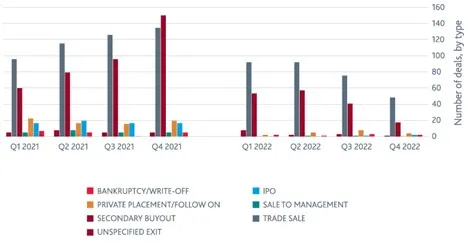

The appetite for exits has steadily declined since the fourth quarter of 2021 as firms have opted to hold onto their investments rather than sell into a weak market. Last year, the majority of exits were secondary buyout and trade sales, according to Preqin. In 2023, we will see more sponsor-to-sponsor deals as well as a healthy number of GP-led secondaries (continuation funds). However, the SEC’s new rules for registered investment advisors (RIAs) may affect the pace at which GP-led secondaries roll out.

Exits by type. 2021-2022

According to Private Equity News, GP-led secondaries today comprise about half the secondary market transaction volume, up from less than one-quarter of the market in 2017, and by 2025 is estimated to exceed $200 billion.

The trend of PE firms evaluating exit planning strategies earlier in the deal lifecycle will continue through 2023. Fund managers will approach the current market slowdown as an opportunity to prepare their investments for exit and execute on the necessary steps to be in position for an IPO or other exit when the market recovers.

Prediction #4: ESG strategies will remain in the spotlight

Private equity fund managers have been focused on incorporating environmental, social and governance (ESG) risk factors and policies into their due diligence, operations and brand identity. ESG will remain a value driver in 2023. As private markets look to ESG as a salve for talent recruitment and retention challenges, macroeconomic volatility and suboptimal exit values, fund managers are increasingly grounding their investment theses in ESG materiality.

| Main Objectives in Developing an ESG Strategy | |||||||

| Improve ability to attract and retain talent | Reflect the funds core business values | Address LP concerns before fundraising | Address material ESG risks in the portfolio | Improve portfolio performance | Do our part to address climate change | Earn higher valuation at exit | Currently do not have an ESG strategy |

| 49% | 44% | 43% | 41% | 40% | 37% | 33% | 1% |

Source: BDO Private Capital Pulse Survey – Spring 2022

According to BDO’s Spring 2022 Private Capital Pulse survey, 50% of fund managers said they would deploy the most capital to setting up impact funds or investing in targets with ESG-focused linked themes. Nearly all (95%) evaluate targets’ ESG potential as part of due diligence. At the other end of the deal lifecycle, 39% identified adopting an ESG strategy and reporting program as a new tactic to facilitate exit strategy.

Private equity’s embrace of ESG is unsurprising: ESG risk assessment is still fairly nascent, and private equity thrives on capturing value from innovation. At the same time, an overwhelming majority of LPs evaluate firms’ ESG risk exposure and practices when making investment decisions (in BDO’s Spring 2021 survey, 94% of LPs said it was either “very” or “somewhat” important that fund managers’ investment strategies include ESG criteria). They see ESG screening as critical to value creation and risk mitigation, protecting investments from risks like health and safety violations, fraudulent governance practices, and extreme weather. And funds, in turn, enjoy more lucrative fundraising opportunities, superior brand reputation, and lower-cost capital.

Prediction #5: Human capital resources will remain tight

The labor market is tight, and employers’ priorities when it comes to their workforce are to retain existing talent and reduce hiring. Of the areas of economic concern fund managers were most concerned about, unemployment rates and the availability of talent ranked above inflation and interest rate increases, according to BDO’s Spring 2022 survey.

Economic Instability Areas of Concern, Ranked

- Regulatory changes

- Geopolitical or social instability

- Unemployment rates and the availability of talent

- Inflation

- Interest rate increases

- Consumer spending

- Income and wage trends

Source: BDO Private Capital Pulse Survey – Spring 2022

Labor, interest rates and inflation are caught in a cause-effect cycle. To counter inflation, the Fed raised interest rates seven times in 2022. The goal is to increase borrowing costs for businesses so they cut back on hiring, theoretically slowing wage growth and impeding consumer spending, and ultimately lowering inflation.

Despite the Fed’s focus on the labor market as part of its effort to bring inflation back to 2%, the labor market has not shown signs of slower wage growth just yet. The first jobs report of 2023 showed 223,000 jobs were added to the economy, most of which were in industries the pandemic hit hardest, like hospitality, healthcare, and accommodation and food services. Outside of the technology industry, there have not been massive layoffs.

There is lively debate around whether the Fed will begin reducing interest rates this year. The minutes from the Federal Open Market Committee’s most recent meeting in December 2022 reveal that the timing is not right to reduce interest rates, but some market experts believe the Fed could lower them toward the end of 2023.

Prediction #6: Private credit financing will continue to grow as part of the share of debt — with caveats

With interest rates at the highest they have been in 15 years, leveraged buyouts are an unappealing prospect for many private equity firms. Yet deals must happen. With high-yield bond and syndicated lenders in skittish territory, dealmakers have been turning to private credit financing — loans negotiated outside the traditional track of bank lenders. Though interest rates may be higher than those offered by traditional lenders who may be more risk averse in today’s climate, private credit lenders are less prone to pull out of a deal at the last minute, enabling fund managers to get to deal close.

While we foresee private credit will continue to gain share of debt, if economic conditions do not improve and a recession does take hold, these lenders could look to prioritize deals in sectors or industries considered recession resilient, such as SaaS software solutions and healthcare technologies.

Debt financing in the private markets rose from less than $500 million a decade ago to $1.2 trillion at the end of 2021, according to Preqin. Preqin also predicts that assets in private debt funds will account for $2.3 trillion by 2027.

Prediction #7: Within value creation strategies, the focus will fall on expense control and operating improvements

The high-valuation deal environment of 2021 began to challenge traditional methods of value creation, forcing firms to seek new ways of generating a return on their investments. Fund managers are using more value creation tactics in more combinations than ever before and are more hands-on with their investments — working alongside portfolio company management to develop digital transformation strategies, for example, and increasing their focus on deepening their industry expertise.

Increased costs arising from inflation may not be recoverable by passing them onto the consumer, further compressing margins and pressuring value creation strategies. Looking forward, fund managers will focus on controlling expenses within this high-inflation environment and making operational improvements — their top two biggest post-M&A challenges, according to BDO’s spring 2022 survey.

| Top post M&A challenges over the next 12 months | |||

| Spring 2021 | Fall 2021 | Spring 2022 | |

| Performance improvement/reducing costs/enhancing revenues | 42% | 43% | 47% |

| Operational improvements | 45% | 38% | 42% |

| Realizing deal synergies and transaction related savings within allotted time/budget | 38% | 35% | 42% |

| Technology/ERP integration and optimization | 41% | 39% | 39% |

| Exit readiness/sell-side due diligence | 22% | 17% | 30% |

| HR/culture integrations/return to office | 23% | 30% | 27% |

| Tax optimization | 23% | 27% | 19% |

2023: Further testing ground for private equity — but not without its opportunities

The private equity asset class is nothing if not creative. With plenty of dry powder available, we expect to see deals return to more normal pre-pandemic levels. Quality assets continue to be fewer and further between, so we anticipate more variation in deal makeup — whether minority stakes, deals with greater ratios of equity, sponsor-to-sponsor transactions or non-platform acquisitions.

To meet the dealmaking challenges of 2023, value creation will be front and center. We expect firms to continue to leverage data analytics — their top tactic for value creation and exit strategy, according to BDO’s spring 2022 survey — for insights into businesses, and to continue to drive innovation. As in 2022, firms that succeed in 2023 will have a strong value creation plan complemented by a comprehensive understanding of risk and a suite of strategies informed by scenario planning.

Hancock Advisors, headquartered in Atlanta, Georgia, provides strategic advice to small and medium size businesses. Our bankers have transaction and industry experience to help owners evaluate, navigate, and successfully execute a full range of strategic transactions. Our clients can range from an early-stage business with break-even operations to $5 million plus of EBITDA with typical enterprise values ranging from $5 to $50 million.